CHRISTIE RAYMOND APPOINTED TO ALLIANT ENERGY BOARD OF DIRECTORS

Alliant Energy Corporation has announced that its Board of Directors has appointed Christie Raymond as a new independent director, effective April 1, 2024. Raymond, 54, brings over 30 years of expertise in marketing, data analytics, new and traditional media, operations, strategic planning, customer satisfaction and several other critical business areas of focus important to the energy industry. Currently, she holds the position of Chief Marketing Officer at Kohl’s.

Alliant Energy Corporation has announced that its Board of Directors has appointed Christie Raymond as a new independent director, effective April 1, 2024. Raymond, 54, brings over 30 years of expertise in marketing, data analytics, new and traditional media, operations, strategic planning, customer satisfaction and several other critical business areas of focus important to the energy industry. Currently, she holds the position of Chief Marketing Officer at Kohl’s.

“We are excited to welcome Christie to Alliant Energy’s Board of Directors,” said John Larsen, Executive Chairman and Chairman of the Board. “Her addition brings a wealth of expertise in customer insights, analytics and engagement. Ultimately, this extensive knowledge will significantly assist us in advancing the customer experience as we deliver on our purpose-driven strategy.”

HOOPER NAMED PRESIDENT OF WE ENERGIES AND WISCONSIN PUBLIC SERVICE

HOOPER NAMED PRESIDENT OF WE ENERGIES AND WISCONSIN PUBLIC SERVICE

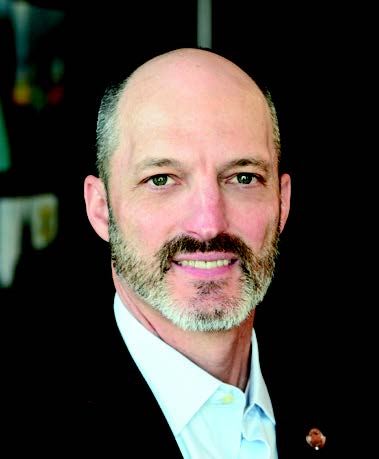

Wisconsin Energy Group has announced that Michael Hooper, currently President and Chief Operating Officer of Northern Indiana Public Service Company a subsidiary of NiSource has been named President of We Energies and Wisconsin Public Service, effective April 1, 2024.

Wisconsin Energy Group has announced that Michael Hooper, currently President and Chief Operating Officer of Northern Indiana Public Service Company a subsidiary of NiSource has been named President of We Energies and Wisconsin Public Service, effective April 1, 2024.

"We're fortunate to have Mike join our senior leadership team," according to Scott Lauber, President and Chief Executive Officer of WEC Energy Group. "He has an impressive record of accomplishments in our industry along with proven leadership skills. His broad experience, together with his demonstrated ability to lead and manage complex projects, will be key in helping us achieve our long-term goals."

Hooper will have primary responsibility for the electric and gas distribution business, customer service, power generation and major projects for We Energies and Wisconsin Public Service.

Hooper holds a bachelor's degree in mechanical engineering from West Virginia Institute of Technology and is a graduate of the Strategic Leadership Program from the Fisher College of Business at The Ohio State University.